Astra has been thrown a critical lifeline in the form of new debt financing, which provides the company with a little more time to find funding to stave […]

Using Affirm on Amazon: How to buy now, pay later this Black Friday

This Black Friday, using BNPL tools like Affirm on Amazon help with budgeting…or romanticize overspending.

Affirm is the first BNPL (Buy Now, Pay Later) service to be available directly through Amazon Pay, and shoppers love it. Last year, BNPL orders increased by 85 percent during Cyber Week compared to the week before, while revenue increased 88 percent. And just a few months back, Amazon Prime Day saw a 20% increase in BNPL use from the previous year. With inflation still wreaking havoc, it’s no stretch of the imagination to guess that Affirm use will remain high for Black Friday 2023.

The ability to pay for items in installments can sweeten your Black Friday prospects. But before going BNPL-wild on your Cyber Week haul, there are some factors to consider about Affirm versus other BNPL apps, as well as the advantages and disadvantages of using these tools in general.

Amazon will drag out Black Friday and Cyber Monday into 11 days of deals beginning Nov. 17

Why Buy Now, Pay Later is so appealing

Layaway programs were popular with shoppers in the ’90s until they were overtaken by credit cards. But there is a key difference between layaway and BPNL. When you put an item on layaway, it was held for you until you paid it off, at which point you could take it home. With BPNL, you get the goods shipped to you right after you order and then pay off that item in installments.

When combined with Amazon‘s typically lightning-fast shipping and Affirm’s lack of late fees, BPNL can make big purchases feel easier to stomach.

Affirm’s interest rates typically range from 0 to 30% APR based on your credit and on the number of payments you select across three to 48 months. Different plans are available for different purchase amounts, and the minimum purchase amount to use Affirm is $50. Affirm’s APR calculator can help you estimate how much interest you’ll rack up on a certain purchase, which could hit $100 or more if you get a loan for, say, a pricey piece of furniture.

When it’s wise to buy now and pay later

-

For some big purchases, using BNPL services may make sense. Breaking up the cost of big investments like a new MacBook Pro or premium robot vacuum can be easier to manage over time than laying down the whole amount in one go.

-

Using BNPL services on necessities like groceries depends on your habits. Habitually funding little daily expenses (like Starbucks) with an installment app can trigger a domino effect of debt, but may work better if you’re buying something like toilet paper in bulk.

-

When used responsibly, apps like Affirm can also help you work around the timing of your paycheck and monthly costs that require an up-front payment, like rent. Be aware that Affirm’s “soft inquiry” to determine your credit won’t affect your credit score, but the company doesn’t promise not to report your payment history to credit bureaus. To make sure you pay on time, we recommend turning on automatic payments and confirming that your payment method won’t expire over the pay period.

When you shouldn’t buy now and pay later

-

Before purchasing with BPNL, consider whether you’d buy that item if you didn’t have the option to break up the payment.

-

Don’t snag something just to hit Affirm’s $50 minimum.

-

Make a wishlist ahead of time if you have to, and hold yourself accountable. The devil on your shoulder saying “You need this, though” can get louder when something is on sale. Especially during Black Friday, you don’t want to cancel out your savings with a serotonin booster that you didn’t know existed five minutes ago.

-

Impulse purchases may feel less risky at the moment, thanks to tools like Affirm. But they can swiftly feel unnecessary once the Affirm reaper returns for payment month after month. Making a series of small payments can create the harmful illusion that you’re spending less money. While that’s technically accurate (and admittedly blissful) for the first few months, you’ll still be spending the same amount of money by the time you’ve paid out every installment.

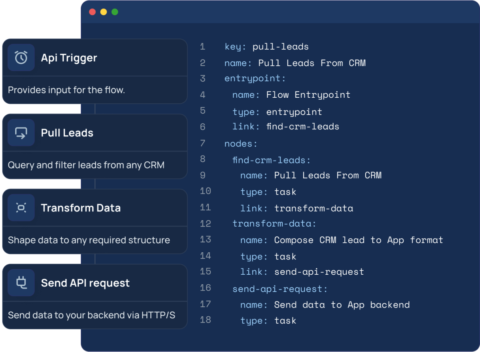

Integration.app uses LLMs to connect apps and services together

Several years ago, Daniil Bratchenko, one of the first employees at DataRobot, the AI and data science platform, observed that enterprises adopting software-as-a-service (SaaS) apps experienced a perennial […]

Volante raises $66M for payments tech for banks and other legacy financial businesses

“Digital transformation” among enterprises hasn’t happened with quite the gusto that people predicted it would a few years ago. But today, a startup building fintech technology — for […]

Will this former future unicorn be sold for parts?

Welcome to the TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s inspired by the daily TechCrunch+ column where it gets its name. Want it in your inbox every Saturday? […]

Sexy Anime RPG Forces Players To Grind To Escape ‘Gem Debt’

Taimanin RPG Extasy is a turn-based gacha RPG in which players unlock new warriors to fight demons and criminal syndicates in a horny sci-fi future. The game’s been live in Japan for years, but only recently came to the rest of the world, and it’s already facing its first major crisis: an outbreak of “gem debt”…