Walmart-backed PhonePe is set to launch its Android app store this week with zero commission for in-app purchases for developers. The app store is based on Indus OS’ tech, a company that PhonePe acquired in 2021.

In this story, we are going to take a look at why developers are pushing for an alternative store and what is the market opportunity for these stores.

Developers’ tiff with Google

In September 2020, Google temporarily pulled Indian fintech giant Paytm’s app from the Play Store citing that the app broke the platform’s rules. At that time Paytm offered fantasy sports app Paytm First, which was also listed on the Play Store. Paytm’s main app also promoted this service, which broke Google’s rule related to sports betting apps in India.

Later that month, a bunch of Indian startups banded together to form a coalition and explore an alternative app store. These executives included Paytm’s Vijay Shekhar Sharma, Deep Kalra of travel ticketing firm MakeMyTrip; and executives from PolicyBazaar, RazorPay, and ShareChat.

Over the years, other startup executives have also complained about Play Store’s 30% fee and have pushed for a “Made in India” app store.

Founder and chief executive officer (CEO) of Paytm Vijay Shekhar Sharma (Photo credit should read SAJJAD HUSSAIN/AFP/Getty Images)

In 2021, Google dropped its commission from 30% to 15% for the first $1 million a developer earned from the Play Store each year.

In 2022, the company started a user choice billing program for limited apps, which allowed them to use other payment processors with a discount of 4% from the Play Store commission.

In January 2023, Google had to allow all apps to use user user-choice billing systems and alternative payment processors in response to a ruling by India’s anti-trust authority.

Last year, when Google announced that it would start enforcing Play Store billing rules, it mentioned that less than 60 developers in India pay more than 15% fees. The company said it has the “lowest rates” for commission for any major app store.

Example of alternative billing system implementation on Google Play Image Credits: Google

Earlier this month, around 30 app makers wrote to Google asking the company to not remove their apps in violation of Play Store billing rules. These companies asked Google to wait till March 19, when their Special Leave Petition (SLP) will be heard by the Supreme Court. Separately, India’s top court has refused to ask Google to potentially delist these apps.

Developers can use Google’s own billing system or use an alternative payment system through user-choice billing. Notably, Google has set March 13 as the deadline to integrate the user choice billing APIs to offer other payment options.

The numbers

India is the top market in terms of downloads, according to estimates by multiple analytics firms. However, the country doesn’t feature in the top 10 (or at times top 20) countries by spend.

According to Sensor Tower, users in India spent $520 million on in-app purchases on the Play Store apps in 2023, up 25% from 2022. Gaming apps accounted for more than half of that spend followed by other categories such as social, entertainment, productivity, and dating. The firm said while users in India download apps 5x more than in the U.S., the spending is almost 25x lower.

Sensor Tower says that over the years, Play Store represented a bigger chunk of in-app purchases in India in 2023 (74%) than in 2020 (56%). Notably, Android has a massive share of the Indian market with more than 90% of smartphone users.

According to data.ai’s State of Mobile 2024 report, only a few apps such as Disney+ Hotstar and ShareChat were top-grossing apps in India across both App Store and Play Store.

Opportunities and challenges

India has more than 750 million smartphone users, so there is an opportunity for app makers for large-scale distribution. Last year, in an interview, Indus OS’ then-CEO Rakesh Deshmukh said that the company had catered to over 200 million users downloading over 2.5 billion apps over seven years.

PhonePe has promised to take no commission from developers at the beginning along with no listing fee for the first year. The company lists on the website an opportunity for marketers to reach “millions” of users. The Indus app store will have to focus on acquiring users and having partnerships with phone makers to achieve that sort of scale.

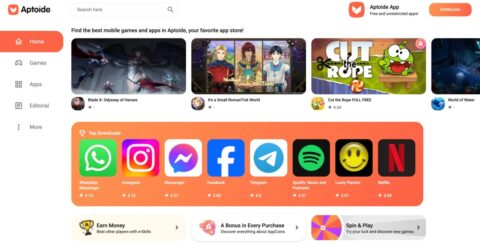

Building alternative app stores at a sustainable level is hard. Paulo Trezentos, who started Aptoide in 2009, told TechCrunch that there are alternative app stores that have to provide value to users. For instance, Aptoide allows users to install an old version of the app that might be suited for their device better.

The store takes a 25% cut if an app uses Aptoide’s own billing service, and a 10% cut if an app redirects users to a website. Trezentos said that out of 100,000 apps on the store, nearly 7,000 apps use the startup’s billing services.

Image Credits: Aptoide

Last year, Aptoide catered to nearly half a billion downloads. While the company also partners with OEMs and carriers, Trezentos said that it operates in a “nearly breakeven” manner by reinvesting any gains in the company.

Trezentos noted that Aptoide has Brazil, India, and Indonesia as countries downloading the most number of apps. However, these countries are not the top revenue sources for developers.

“These countries provide a massive scale for developers. So developers need to focus on ease of payments and creating more value for users in these markets,” he said.

PhonePe has previously said that it is banking on the fact that India will potentially have more than a billion smartphone users by 2026. It is also providing a launchpad for some developers under its accelerator program with benefits like better visibility on the PhonePe store.

Google (and Apple) have been persistent about how their app distribution channels are secure and private. Google also shows warnings on the phone when you try and install apps from alternative sources.

PhonePe will need to have robust security to block out malicious apps. The company has to convince users that its store provides more value than the default Play Store to keep having them download apps from the new store.