According to the Harvard Business Review, most mergers fail to achieve their ideal outcomes. The stats are even worse in the professional services and tech sectors, where as many as 90% of mergers can be considered failures.

There are two reasons why this is the case. First, poor due diligence combined with inadequate strategic and tactical planning are to blame, ultimately impeding success. Second, it’s a matter of execution failures due to weak branding and communications and insufficient cultural integration and customer engagement, all of which create unforeseen barriers that inhibit the realization of the merger’s objectives.

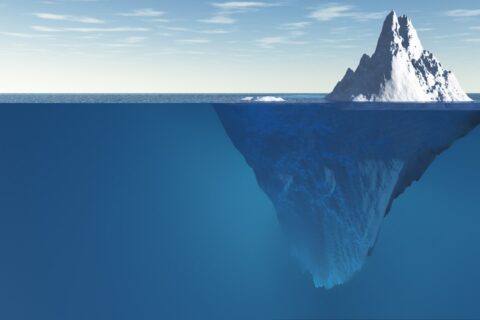

In my experience, it’s the latter that businesses need to be most wary of — an iceberg of sorts. While only one piece may be visible at a time, it can sink your ship, fast. Navigating around and through these impediments will have a dramatically positive impact on merger success. And by closely examining these “possible points of failure,” we can address them and avoid them altogether.

To do that, you must consider everything related to your merger via three progressive lenses.

Editor’s note: This is part one of a two part series from David Martin. The second part will be published tomorrow, November 28.

Lens 1: Business strategy

When companies come together, there’s no shortage of consultants poised and ready to provide counsel. Unfortunately, most will inherently focus on supply-side issues like structure, cost synergies, and talent rationalization. Few concentrate on the demand side of the equation, which is one of the most critical points of failure.

Major mistakes were made over the years in the name of realizing cost savings by moving too quickly to unveil a new merged brand without carefully migrating existing brand equities.

Through this first lens, leadership must understand where demand-side synergies exist. Identifying and understanding vertical synergies — that is, the benefits of linking business units to a new, ideally more powerful parent — is always step No. 1. But the real value comes from understanding the horizontal synergies — that is, what happens if we bring together business unit A with business unit B? What possible opportunities might there be to bring new capabilities to market that help clients/consumers do things they’ve otherwise never been able to do before? Or how does the integration of units A and B open the door to creating a truly end-to-end solution that might turn the market to our advantage?

The voice of the customer interviews is as versatile as it is helpful in this case, and by talking to friendly clients, you can get a clear sense of the opportunities they expect the merged entity to deliver that neither partner alone could have. These also create a distinct opportunity for businesses to engage with their current clients as partners and weave them into the integration in a productive way. I’ve seen firsthand how customers can shift their allegiances during this stage as they feel they have a stake in the new firm’s future and feel invested in its success.

By focusing on the business strategy first, you can capture inputs and insights on what the newly merged brand must enable, including how the product and service portfolio must be organized to realize demand synergies.