Fresh off the success of its first mission, satellite manufacturer Apex has closed $95 million in new capital to scale its operations.

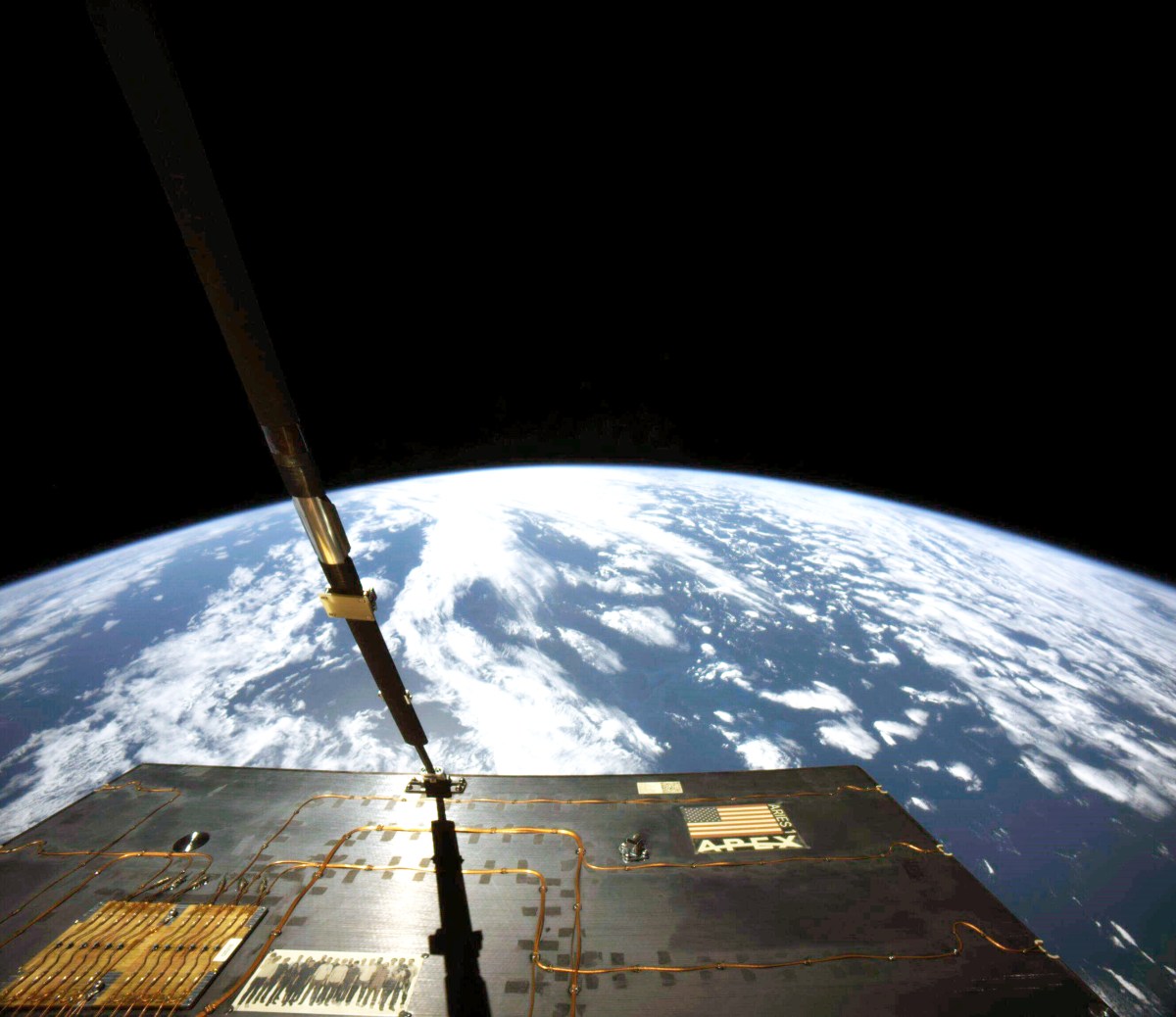

The Los Angeles-based startup successfully launched and commissioned its first spacecraft, a model called Aries, in March. That mission has gone off seemingly without a hitch — a rarity in the space industry — and with flight heritage now achieved, the company is squarely focused on growth.

That includes scaling up production of the Aries vehicle and investing in the development and production of Nova, a spacecraft that’s around twice the mass of Aries. The company is on track to manufacture five Aries this year alone, Apex CEO and co-founder Ian Cinnamon told TechCrunch.

Apex was founded on the thesis that the one of the main bottlenecks facing the growth of the space industry was satellite bus manufacturing. Cinnamon and his cofounder, Maximilian Benassi, are aiming to essentially productize (i.e. manufacture and sell in standard formats) satellite buses — which have historically been subject to bespoke engineering processes and very long lead times — and rapidly scale the ability for companies to send their payload to orbit.

The very innovations that have increased demand for access to space — namely the drop in launch costs thanks to SpaceX Falcon 9 ride-share missions — have also set the conditions for a productized spacecraft to win on the market. Up to a certain volume size, customers are paying the same for a ride to orbit — so Cinnamon and Benassi realized that spacecraft could be standardized, and even slightly over-engineered, with no additional cost by way of launch to the customer.

Focusing on productization has generated a strong foundation for the business, Cinnamon said. “For every one of the satellite buses that we’ve sold or are in the process of selling, we’re able to very clearly point out, here’s the selling price, here’s our unit economics, here’s the margin we have,” he said. “We tend to be very transparent with our customers as well that we’re not trying to be the lowest price on the market … we’re occasionally able to charge a premium for a very fast delivery time frame.”

This clear economic picture no doubt proved compelling to investors. While there’s been a lot of buzz around hard tech recently, “investors still have that strong desire to put their money to work on businesses where they can really see the fundamentals,” Cinnamon said.

One tailwind for the company, according to Cinnamon, is that most customers are not interested in buying a single satellite, but in buying multiple, with purchases often extending over time as a constellation is built out.

The company is approaching fifty people and that number is likely to double by the end of this year.

The funding round was led by early Apex investors XYZ Venture Capital, and co-led by CRV, along with participation from new investors Upfront, 8VC, Toyota Ventures, Point72 Ventures, Mirae Asset Capital, Outsiders Fund, GSBackers, and existing investors Andreessen Horowitz, Shield Capital, J2 Ventures, Ravelin, Robinhood co-founder Baiju Bhatt and Avalon Capital Group.